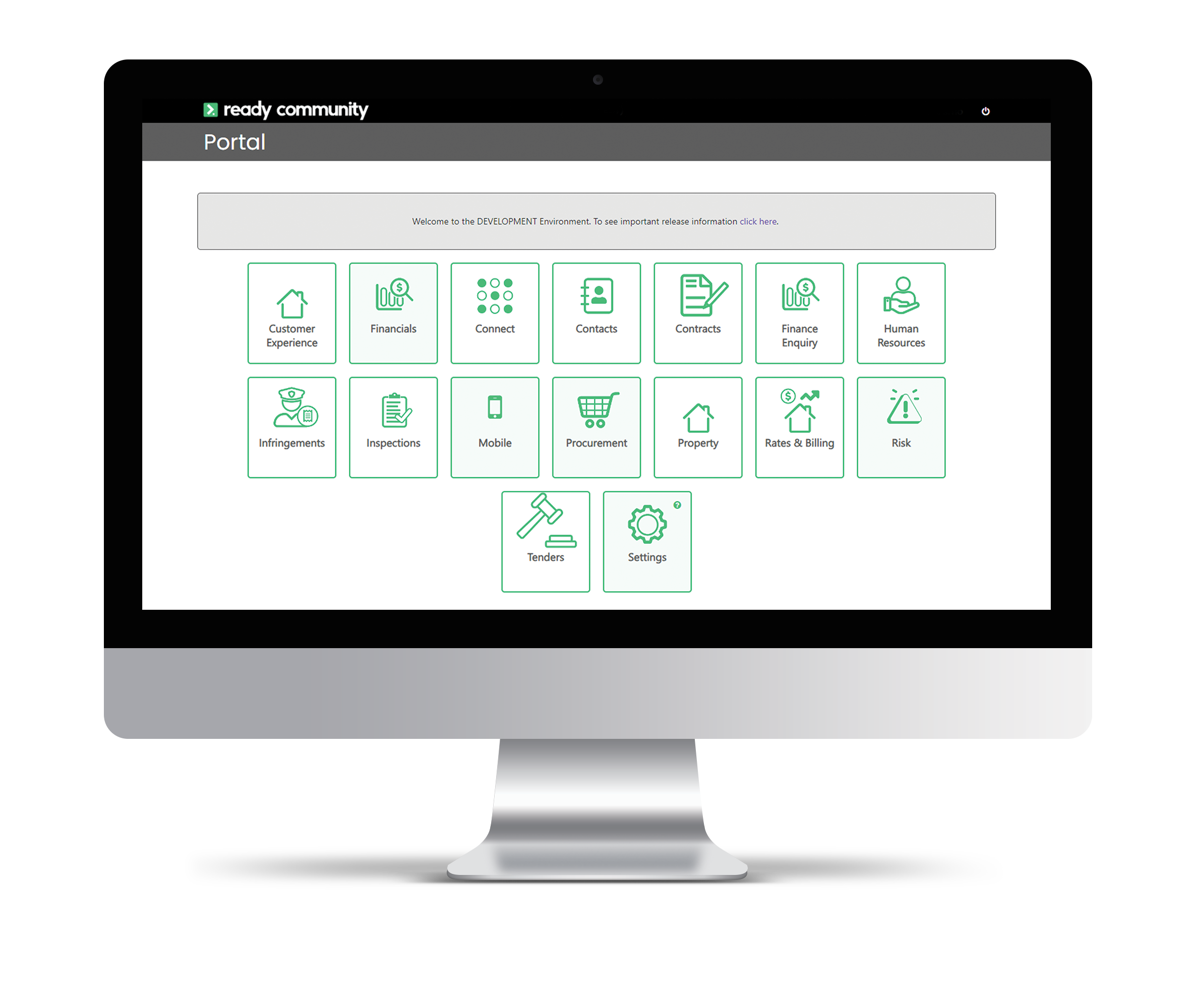

Ready Community Financials

An integrated financial management solution for the public sector.

Ready Community Financials offers a portfolio of financial tools delivered through a simple and highly engaging user interface. The application enables the efficient management of transactions, aggregation of information, and support for the real-time management of your organisation’s finances.

The solution is a cloud-based financial, accounting and business management system that is accessible from anywhere, anytime. Nimble enough for small Local Government and powerful for larger Local Governments, Ready Community Financials is easy to implement, fast to configure and simple to use.

This integrated financial solution streamlines operations, handling the general ledger, payables, receivables, inventory, analytics, fixed assets, and cash flow, even managing tasks like bank reconciliations and collections across different currencies, locations, or companies. It also prioritises cybersecurity, business continuity, audit control, organisational governance, and workflow for a user-friendly and adaptable experience, delivering lasting value.

Features

A modern platform for the end-to-end management of your financial transactions

Simple and engaging

User-friendly interface designed to create efficiencies

Seamless integration

with Ready Community Payroll, Contacts and Content

Full suite of accounting tools

Including the core General Ledger, Accounts Payable and Receivable, and Project Accounting

Simple Automations

Automate closing end of month and EOFY processing, saving hundreds of hours

Benefits

Access important financial information at any time, from any location.

Cloud-based accounting

No need to install software - it's always available and up to date in the cloud

Cost and time savings

Driven by the reduction in system management and transactional processing effort.

Modern workflow

Electronic processing and integrated approvals eliminates paper-based processes

Made for local government

Built with a deep understanding of the unique regulatory requirements and compliance obligations of local government organisations

Bank Reconciliations

Within Ready Community Financials, we have reinvented the bank reconciliation process, empowering you to automate repetitive tasks and ensure that reconciliations are completed quickly and accurately.

Allow users to load Bank Statement information from their bank or financial institution and submit a balanced bank reconciliation summary to a supervisor for approval. In addition, users can correct or manually match any remaining bank and general ledger transactions using the platform. The platform has the capability to create new receipts and expense payments directly within the Bank Reconciliation interface, which also automatically suggests reconciliation matches with your accounting data.

Create new receipts and expense payments directly within the Bank Reconciliation interface

Automatically suggest reconciliation matches with your accounting data

Correct or manually match any remaining bank and general ledger transactions

Your hub of contact information such as names, addresses, telephone numbers, and email addresses.

A modern, cloud-based people management platform.

Ready Community Business Intelligence transforms machine data into trends and populations that enable predictive business activities and risk management.

Your hub of contact information such as names, addresses, telephone numbers, and email addresses.

A modern, cloud-based people management platform.

Ready Community Business Intelligence transforms machine data into trends and populations that enable predictive business activities and risk management.